The President of the Republic of Ecuador has submitted the “Law for the Control of Irregular Capital Flows” bill to the National Assembly. The most important tax provisions are detailed below:

- Income Tax on Dividend Distribution

Profits or dividends distributed by entities with tax residence in Ecuador or permanent establishments located in Ecuador to its shareholders will be subject to a unique income tax.

The applicable rates are:

- 12% in general.

- 10% for distributions to individuals and entities that do not have tax residence in Ecuador.

- 14% in the following cases:

- If the distribution is made to non-resident entities when: (i) a resident of a tax haven or low-tax jurisdiction is part of the ownership structure, and (ii) the final beneficiary is a tax resident in Ecuador.

- If the local company distributing the dividend fails to report its ownership structure.

The following exemptions are established:

- The dividend distributed to another entities with tax residence in Ecuador or permanent establishments located is not considered taxable income, and

- If the dividend recipient is an individual with tax residence in Ecuador, an exemption applies equivalent to 3 minimum wages received by each company distributing the dividend, within the same fiscal period.

Dividends distributed between January 1, 2025, and the first day of the month following the effective date of this law, to individuals with tax residence in Ecuador, will be consolidated with global income and will be subject to taxation according to the applicable progressive tariffs.

- Advance Income Tax on Undistributed Profits

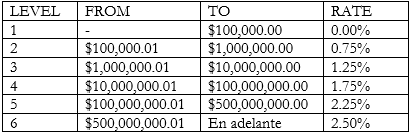

Entities with tax residence in Ecuador and permanent establishments located in Ecuador, that as of July 31 of each fiscal year, do not distribute its retained earnings from previous years, are subject to pay the following:

This amount may be offset by the company with the corporate income tax during the two subsequent fiscal years. If the credit is not offset during this period, it will not be subject to a refund and will be recorded as a non-deductible expense in the respective year.

This payment is not applicable for: (i) trusts that do not carry out business activities or operate ongoing businesses; (ii) non-profit organizations; (iii) public companies; (iv) mixed-economy companies with respect to the Governments’ share.

Effectiveness of the Provisions

These provisions will come into force on the first day of the month following the publication of this law in the Official Registry.

Andrea Moya, Socia en CorralRosales

amoya@corralrosales.com

+593 2 2544144