In the Third Supplement to Official Gazette No. 195, dated December 31, 2025, an amendment was published to the General Regulations of the Mining Law (referred to as the “Regulatory Amendment”). This amendment incorporates various matters that were previously established through secondary regulations. The most significant provisions of the Regulatory Amendment are as follows:

Powers of the Mining Regulation and Control Agency (“ARCOM”)

It is clarified that ARCOM has jurisdiction over the statistical records of production and the commercialization activities of mining products, and that it regulates the technical and operational aspects of the mining sector, as well as being empowered to issue regulations.

Filings with the Mining Registry

In addition to all documents (administrative acts, contracts, etc.) that must be registered in the Mining Registry, it is provided that those determined by the sectoral Ministry (the “MEM”) may also be registered.

In the event of an unjustified express or tacit refusal to register, or a failure to issue a registration decision within the established terms and deadlines, an administrative disciplinary proceeding shall be initiated against those responsible.

Grounds to cancel the registration of titles, acts, and contracts in the Mining Registry

It is clarified that any ground for cancellation of a registration must be duly evidenced and decided in administrative proceedings.

Holders of mining rights

It is established that holders of mining rights (natural persons and legal entities) must have a corporate purpose that includes the carrying out of mining activities in the phases referred to in the Mining Law, as well as a tax compliance certificate issued by the Internal Revenue Service (the “SRI”).

Content of bids for the granting of metallic mining concessions through the auction and public tender process

In addition to the previously established requirements, the following must be provided: (a) the full names and corporate name or legal designation of the bidder; (b) the appointment or power of attorney for the legal representative if the bidder is a legal entity; and (c) a technical proposal outlining the exploration and exploitation process. Furthermore, it is now stated that the Ministry of Energy and Mines (MEM) may establish additional requirements in the instructions issued for the process.

Definition of Mining Project

A Mining Project refers to an area that consists of one or more contiguous mining concessions owned by the same titleholder. This project is aimed at discovering, assessing, quantifying, and exploiting a mineral deposit. Due to technical and operational reasons, as well as the characteristics of the mineral deposit, a Mining Project involves various operations, works, and activities focused on preparing and developing the deposit, as well as extracting and transporting the minerals.

In the exploitation phase, a Mining Project may not exceed 5,000 hectares. However, the titleholder is permitted to hold one or more projects that are in the exploration or development stages.

Definition of the Initial Exploration Period

The Initial Exploration Period is the period intended for the manual collection of samples of rocks, soils, and fluvial sediments; data collection through geophysical methods; opening of trails, trenches, exploratory pits, test or reconnaissance drillholes; and other activities permitted under applicable regulations, which includes the installation of temporary camps and the necessary infrastructure for the execution of initial exploration activities within a mining concession.

The maximum term of this period shall be up to four (4) years.

Start of the initial exploration period or simultaneous activities

Once the concession has been granted, the concessionaire must initiate the process to obtain the necessary Prior Administrative Acts outlined in the Mining Law within sixty (60) days of receiving the mining title. These acts include: (i) obtaining the environmental license from the environmental authority; (ii) securing a certificate of non-affectation of water sources from the water authority; and (iii) submitting a sworn statement confirming that the activities will not impact public infrastructure.

Within five (5) days after the sixty (60)-day period, the concessionaire must submit a simple copy of the filing record, along with an acknowledgement of receipt and any official documents (such as a certificate or notarized act) that demonstrate that these procedures have been initiated by the MEM. If such documents are not submitted, the MEM will determine and declare the beginning of the Initial Exploration Period or the Simultaneous Activities, as applicable.

After obtaining the Prior Administrative Acts, and if the concessionaire has provided timely evidence of initiating the necessary procedures, the concessionaire must request the MEM to issue a declaration confirming the start of the Initial Exploration Period.

Additionally, the MEM must be informed (and served with notice) regarding the issuance or obtaining of all Prior Administrative Act.

Change from the Initial Exploration Period to the Advanced Exploration Period

Sixty (60) days before the end of the Initial Exploration Period, the mining concessionaire must submit to the MEM an application to change to Advanced Exploration, which shall include:

- An express relinquishment of a portion of the total surface area of the concession as originally granted;

- In the case of concessions obtained through auction or tender processes, evidence of compliance, during the Initial Exploration Period, with the activities, minimum investment amounts, and committed investment proposed in the economic bid;

- A final audited Initial Exploration report.

Advanced Exploration Period

If the application to change periods satisfies all requirements, ARCOM must issue a report covering: (i) compliance with the minimum and committed activities and investments completed, and (ii) adherence to legal and economic obligations during the Initial Exploration Period.

Once a favorable report is issued, the MEM must approve the change to the Advanced Exploration Period within ten (10) days.

The Advanced Exploration Period will begin from the date the resolution to commence this phase is issued, provided that the necessary environmental authorization (environmental license) has been obtained.

Economic Evaluation Period

Once the Advanced Exploration Period has concluded, the mining concessionaire shall have a period of up to two (2) years to carry out the economic evaluation of the deposit and to request, before its expiration, the commencement of the exploitation stage. The economic evaluation period of the deposit, or any extension thereof, shall be counted from the date of registration of the administrative resolution granting the commencement of the economic evaluation, issued by the MEM.

Negotiation of the Mining Exploitation Contract

During the Economic Evaluation Period, the concessionaire is required to initiate the pre-contractual negotiation of the Mining Exploitation Contract. The application must include certified copies of previous administrative acts and a Project Feasibility Report, prepared by qualified individuals (Qualified Person, “QP”) in a standard format recognized by the Committee for Mineral Reserves International Reporting Standards (CRIRSCO), the SAMREC code, or other similar or superior standards. This report must be in Spanish and not older than thirty-six (36) months from the date of submission.

At any stage of the pre-contractual negotiation process, the MEM may order the review, modification, or renegotiation of the previously agreed terms, conditions, and clauses as necessary to protect the interests of the State or to ensure compliance with applicable regulations and public policies in the mining sector.

Request to change the phase to exploitation in large-scale mining

For concessions under the large-scale mining regime, once the terms, rights, and obligations of the parties have been determined in the pre-contractual negotiation before the execution of the exploitation contract, and the MEM has approved them in the final negotiation minutes, the concessionaire must request the declaration of commencement of the exploitation phase, attaching the following information:

- A report prepared in accordance with ARCOM guidelines regarding payment of administrative processing fees and conservation patents, as well as compliance with minimum activities and investments;

- The Project Feasibility Report;

- Partial relinquishment of the concession if the area to be exploited exceeds five thousand (5,000) mining hectares.

Request to change the phase to exploitation in medium-scale mining

For concessions under the medium-scale mining regime, within ninety (90) days before the expiration of the Economic Evaluation Period or any extension thereof, the concessionaire must request from the MEM the transition to the exploitation phase, attaching the following information:

- A report prepared in accordance with ARCOM guidelines regarding payment of administrative processing fees and conservation patents, as well as compliance with minimum activities and investments;

- The Project Feasibility Report;

- Partial relinquishment of the concession if the area to be exploited exceeds five thousand (5,000) mining hectares.

Assignment or Transfer and Pledge Assignment of Mining Rights

In authorization proceedings for the assignment or transfer of mining rights, one requirement has been modified, requiring that the application identify the exact natural person or legal entity to whom the mining right will be assigned or transferred, as well as the percentage of the assignment.

Mining Operation Contract

It is established that in mining operations and assignment-of-mining-rights contracts, in addition to the agreements stipulated by the parties, the contractors’ subrogation in the compliance with environmental and mining regulations, and other obligations corresponding to the concessionaires, must be included. Breach of such obligations shall constitute grounds for suspension of mining activities, without prejudice to any administrative, tax, civil, and criminal liabilities that may arise.

Mining operation contracts and assignment-of-mining-rights contracts will now require a favorable report from ARCOM and the MEM.

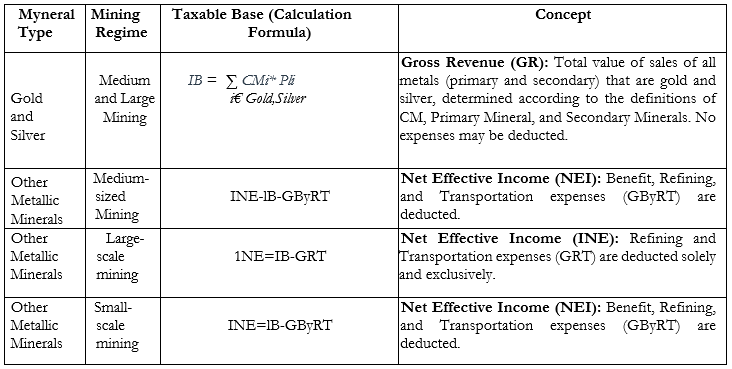

Calculation of the taxable base for metallic mining royalties

The concessionaire must pay the royalty in accordance with the percentages established in the Mining Law (between 3% and 8%) or as stipulated in the exploitation contract. The royalty shall be calculated based on the effective sale of the mineral, applying the following differentiation in determining the taxable base:

- Metallic minerals: gold and silver

In the case of exploitation and sale of gold and silver, the taxable base shall be the Gross Revenue from sales of the primary and secondary minerals.

- Other metallic minerals

In the case of exploitation and sale of other metallic minerals, the taxable base shall be the Net Effective Revenue Received, determined as follows.

For small-scale mining and medium-scale mining, Net Effective Revenue shall be determined by deducting from Gross Revenue the expenses incurred in the beneficiation, refining, and transportation phases.

For large-scale mining, Net Effective Revenue shall be determined by deducting from Gross Revenue the expenses incurred solely and exclusively in the refining and transportation processes.

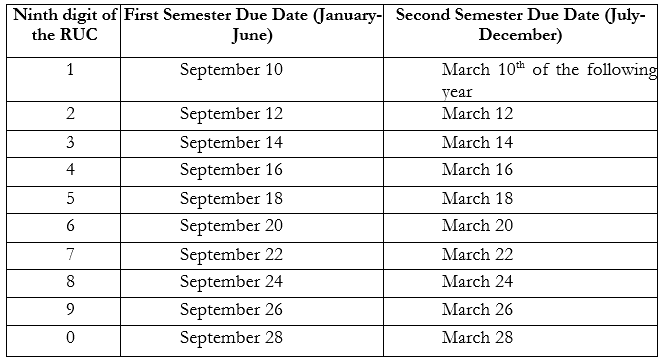

Taxpayers shall assess, report, and pay royalties on a semiannual basis in September and March of each year, according to the ninth digit of the taxpayer identification number (Registro Único de Contribuyentes – RUC), on the dates indicated below and using the forms that the SRI shall establish for such purpose:

For the calculation of royalties, it is mandatory to consider the information reflected in the tax returns and information submitted to the SRI, and that determined by the SRI in administrative acts, as well as the record of the semi-annual production reports submitted to ARCOM. For this purpose, the SRI will issue the necessary resolutions.

Mining Royalty Formula for Medium and Large-Scale Mining (RMG)

The mining royalty for medium and large-scale mining (RMG) shall be calculated annually based on the corresponding tax base, as follows:

RMG^Taxable Base x % Royalty

Where:

- RMG: the total value of the mining royalty payable.

- %Royalty: the percentage of mining royalty set by the competent authority within the legal range applicable to the corresponding mining regime.

- Taxable Base: the value to which the royalty percentage is applied, which is determined as follows:

Additionally, the definitions of Quantity of Metals, Principal Mineral, Secondary Minerals, Gross Income, among others, are included.

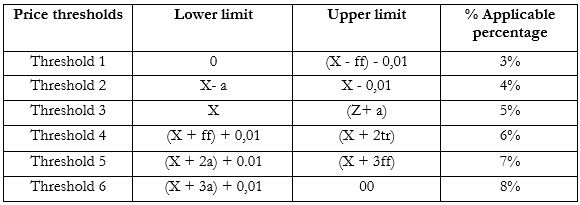

Formula for calculating the royalty rate applicable to the medium-scale mining regime

The effective royalty rate applicable to the Taxable Base of each mineral under the medium-scale mining regime shall be set as a function of the historical price indices for the last ten (10) years, applying a distribution based on progressive threshold bands.

For purposes of determining the applicable price threshold, the mining concessionaire shall consider the mineral’s quoted sale price at the time of sale or export of the mineral. Such price shall be compared against the table of the Progressive Price Thresholds then in force, and the calculation of the Effective Rate shall be carried out in accordance with the methodology set forth below.

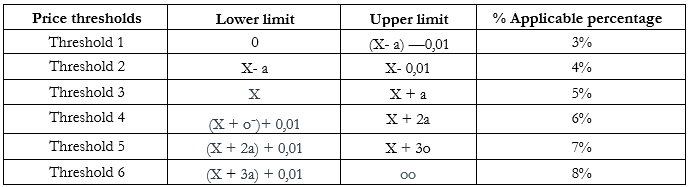

C. Progressive Price Thresholds. The applicable royalty rate shall fall within the range of three percent (3%) to eight percent (8%) established in the Mining Law. It shall be set in accordance with the price thresholds, which shall be determined for each mineral by the Sectoral Ministry, based on the following structure:

Where:

X (Average): Corresponds to the average of historical price indices for the last ten (10) years.

a (Standard Deviation): This is the square root of the historical price variance, used as a parameter to establish the royalty application ranges.

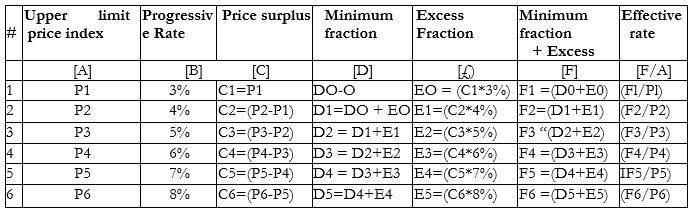

D Effective Tax Rate Formula. The effective tax rate for each mineral will be determined using the following progressive calculation scheme, which illustrates the application of the tax rate at each threshold. The result of the Effective Tax Rate will be the final percentage applicable to the Taxable Base of the mineral:

Where:

- P: Corresponds to the prices determined in section A. Progressive Price Thresholds.

- Minimum Fraction (D): This is the sum of the royalty values calculated in all the previous price ranges.

- Surplus Fraction (E): This is the royalty value generated by the surplus in the threshold price, multiplied by the corresponding Progressive Rate.

Update of Price Threshold Tables by Mineral

The MEM, through the Subsecretariat of Industrial Mining, will update the price threshold tables semiannually, based on prices recorded in the January to June and July to December periods. These tables shall be published on the official website of the MEM no later than the fifteenth (15) of July and the fifteenth (15) of January each year.

Determination of Price Thresholds for Royalty Application in the Large-Scale Mining Regime

Under the large-scale mining regime, the royalties established in the Mining Law shall be applied in accordance with a table of price thresholds for each mineral subject to exploitation. This table will be based on the technical-economic analysis conducted at the time of the negotiation of the mining exploitation contract. It will be included as an annex to the agreement.

For the determination of these thresholds, the historical price behavior over the last ten (10) years will be used as a reference, employing a statistical analysis using quartile distribution and standard deviation, according to the following procedure:

- Lower Threshold: The price below which the minimum royalty rate of three percent (3%) will apply.

- Upper Threshold: The price above which the maximum royalty rate of eight percent (8%) will apply.

- Intermediate Thresholds: These shall be set with uniform increments between the minimum and maximum thresholds, based on the price standard deviation during the analyzed period.

As per the following table.

Where:

- X = Average price of each mineral, determined based on statistical analysis of the last ten (10) years.

- a (Standard deviation): square root of the variance of historical prices, used as a parameter to establish the royalty application ranges.

The application of the threshold table will be made for each mineral considered in the mining project’s cash flow and will be included in the respective mining exploitation contract.

The determination of the formula and thresholds will serve as the technical reference basis for negotiations on the mining exploitation contracts. Within the framework of the pre-contractual negotiation tables, the parties may adjust the threshold values and the standard deviation (a) to adapt them to the specific conditions of each project, while always respecting the initial calculation as the starting point.

Thus, it is stated that the setting of royalties ensures the negotiable character inherent in the contractual process, without implying disregard for the technical parameters established by the methodology set out in the Regulations.

Parameters for the Distribution of Profits and Royalties

It is reaffirmed that 60% of the profits and royalties will be allocated to social investment projects, primarily aimed at addressing unmet basic needs and territorial or productive development, through the Decentralized Autonomous Governments (“GADs”).

The profits from small, medium, and large-scale mining projects shall be paid to the State, with 60% transferred to the GADs, who will allocate them to social investment projects and territorial development in the areas of influence where the mining project is developed.

The distribution of profits and royalties established in the Mining Law and in the Regulations among government levels shall be as follows:

- 45% for provincial GADs,

- 35% for municipal GADs and

- 20% for parish GADs, located in the areas of influence.

Before disbursing funds from mining profits and royalties, the GADs must present and register with the MEM a detailed plan for prioritized social investment and territorial development projects, including: project costs, execution timelines, impact indicators using international methodologies, and their utility.

The projects must be consistent with the data registered in the Information System for the GADs, and the sectoral Ministry will approve or reject the project, without prejudice to the oversight actions carried out by the Comptroller General of the State in the execution and compliance of these projects.

ARCOM will send a report to the MEM, including the cadastral code, the name of the mining concession, the applicable regime, and all other relevant data for complete identification of the technical and economic details of the mining rights.

The MEM must assess the validity of the information provided by ARCOM to determine the percentage of the mining right area that lies within the province, canton, and parish. The relevant formula will then be applied in accordance with the respective formulas.

Finally, ARCOM must send a technical report to the MEM with the exact values for each government level. The MEM will then send this information to the public finance authority detailing the values to be transferred to the GADs in the areas of influence where mining activities are taking place, through transfers made within each fiscal year, based on the revenues collected in the National Treasury Single Account.

These revenues include royalties, profits, and funds from service provision contracts. These assigned values will not accumulate for subsequent fiscal years.

Mining Profits and Royalties in the Special Amazonian Territorial District

60% of the royalties will be allocated to social investment projects primarily aimed at addressing unmet basic needs and territorial or productive development, through the GADs.

The profits from small, medium, and large-scale mining projects will be paid to the State, with 60% transferred to the GADs, which will allocate them to social investment projects and territorial development in the areas of influence where the mining project is developed.

Revenues from profits and royalties for mining rights located in the provinces of the Special Amazonian Territorial District will finance the Common Fund for the Special Amazonian Territorial District. They will be invested and allocated in accordance with the law governing them.

To identify 60% of the profits and royalties to be allocated to the Common Fund, ARCOM will request a semiannual report from the SRI detailing the amounts collected from profits and royalties. This report will indicate the amount corresponding to each mining right, as recorded in the relevant form, according to its cadastral code.

Before disbursing mining royalties, GADs must present and register with the MEM a detailed plan for prioritized social investment and territorial development projects, including project costs, execution timelines, impact indicators using international methodologies, and their utility. Projects must be consistent with the data registered in the Information System for the GADs, and the MEM will approve or reject the project, without prejudice to the oversight actions carried out by the Comptroller General of the State in the execution and compliance of these projects.

ARCOM, considering the information sent by the SRI, will prepare a detailed technical report on each mining right located in the provinces of the Special Amazonian Territorial District and will send it to the MEM semiannually, which will include cadastral certifications by hectare, specifying the percentage of the mining right’s surface area corresponding to each province, canton, and parish.

Once the MEM validates the information, it will send the details to the public finance authority. Finally, the public finance authority will transfer the funds to the Common Fund for the Special Amazonian Territorial District.

Calculation of the Extraordinary Income Tax

The article on the calculation of the Extraordinary Income Tax, which applied to both primary and secondary minerals, has been eliminated.

Sovereign Adjustment

For the calculation of the sovereign adjustment, the base period was previously considered to be the entire duration of the mining concession, including auditing, oversight, and fiscal analysis. Now, only the validity period of the mining exploitation contract will be considered.

The mining concessionaire must provide ARCOM and SRI with all information related to the composition of the cash flow, financial statements, and other necessary data for verification of the sovereign adjustment. Amounts paid for the sovereign adjustment will not be considered deductible expenses for income tax purposes.

In case the State receives benefits from the exploitation of the mining concession that are lower than those obtained by the titleholder, the sovereign adjustment will be computed and paid by June 30 of the fiscal year immediately following the year in which such an imbalance occurred, in accordance with the established formula.

Fines

A new fine has been added for those who invade border security zones, reserved security areas, strategic sectors of national defense, or those areas determined by the Public and State Security Law, in areas with mining concessions or artisanal permits, and carry out operations within or outside of these concessions or permits, violating the rights of the State or the mining titleholders. These infractions will be penalized with a fine of up to three hundred (300) unified basic wages.

Additionally, tools, equipment, and production obtained will be confiscated.

Administrative Protection Process

In addition to previously established grounds for requesting administrative protection from ARCOM – in cases of invasion, intrusion, dispossession, or other forms of disturbance that impede or threaten the regular and safe exercise of mining activities – it is now added that administrative protection may also be requested against disturbances, acts, or actions by authorities acting outside their jurisdiction.

The obligation for the concessionaire to provide the names and surnames of those causing the disturbance has been eliminated. If the identity of the alleged disruptors is unknown, the mining titleholder must submit a declaration stating that they do not know the identity of the alleged disruptors.

Within the administrative protection process, once the claim is accepted, the citation of alleged offenders has been eliminated, and ARCOM must order an inspection within a maximum of 5 days of the issuance of the initial order.

Power Generation for Operations

In the General Provisions, it is established that the mining concessionaire, as appropriate, must implement an electrical power generation system with sufficient capacity to meet the entire energy demand of the operation, in accordance with the Public Electricity Service Law, its regulations, and applicable legislation.

Requirements to Obtain a Mineral Marketing License

In the General Provisions, additional requirements for submitting a marketing license application include: (i) registration with the Financial and Economic Analysis Unit (Unidad de Análisis Financiero y Económico – UAFE); and (ii) proof of assets amounting to at least USD 400,000 for legal entities and USD 250,000 for natural persons.

Non-retroactivity

In the General Provisions, it is established that the provisions on the distribution of mining profits and royalties do not apply retroactively.

Execution of Mining Activities under the Special Small-Scale Mining Regime and Its Extinction

Under the General Provisions, it is determined that, under the special small-scale mining regime, once the prior administrative acts for the commencement of activities have been obtained, concessionaires are obligated to immediately and continuously commence mining activities as authorized, in accordance with the approved work plan and schedule by the MEM.

If, within four (4) years of registering the mining title, it is proven that the concessionaire has not obtained the prior administrative acts due to their fault, and consequently has not begun activities or has begun them without meeting these requirements, the concession will be declared null and void by law for failure to comply with the obligations inherent in the mining title.

If the concessionaire has obtained the prior administrative acts, they must request the commencement of mining activities within thirty (30) days of their issuance.

If the request to commence activities is not made within four (4) years from the registration of the mining title, the concession will be declared null and void by law for failure to comply with the obligations inherent in the mining title.

Once the title is voided, the concession will revert to the State without any right to compensation.

Transitional Provisions

Within ninety (90) days, the MEM, ARCOM, and SRI will issue the technical standard to determine the items, limits, and references for calculating royalties based on net revenues from primary and secondary minerals other than gold and silver.

Within thirty (30) days, the MEM and ARCOM will update the Instructions for obtaining Licenses for Marketing and Export of Minerals.