On October 27, 2025, the President of the Republic of Ecuador issued the Law on Social Transparency Regulations. Below, we summarize the provisions regarding the Advance Payment on Undistributed Profits:

- General Regime

a. Calculation Formula

The advance payment will be calculated as follows:

- Profit (+) or loss (–) from the immediately preceding fiscal year: accounting profit or loss, minus employee profit-sharing, minus income tax expense, minus legal reserve.

- To this amount, the accumulated profits (+) or losses (–) from prior fiscal years (other than those mentioned above) shall be added or subtracted.

- (–) The value of dividends distributed between January 1 and July 31 of the fiscal year in which the advance payment is determined shall be subtracted.

- (–) The capitalization of profits made between January 1 and July 31 of the fiscal year in which the advance payment is determined shall also be subtracted.

- Adjustments for income valuation under the equity method for the previous period (+/–) shall be added or subtracted.

- The progressive rate established in Article 39.2.1 of the Internal Tax Regime Law shall then be applied to this base to determine the amount payable.

b. Payment Methods and Dates

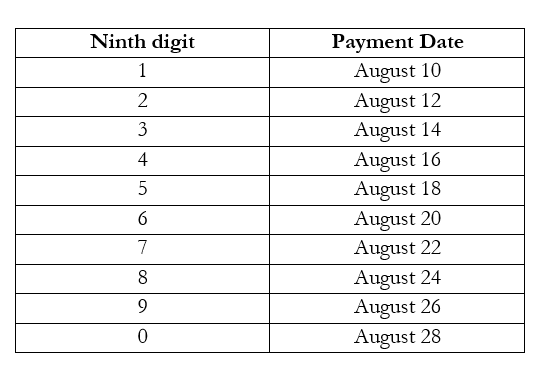

Taxpayers must declare and pay the applicable value in the month of August according to the ninth digit of the tax ID:

- Special taxpayers must make the payment by the 11th day of the due month.

- Payment may be deferred up to three equal installments to be paid in August, September, and October of each year.

- Entities that do not exceed the exempt threshold of USD 100,000.00 are not required to file the declaration.

c. Offset and/or Refund for Dividend Distribution or Capitalization

The amount paid in advance may be offset if dividends are distributed or profits are capitalized, following this order of priority:

- Dividend Distribution:

- Offset first against the withholding tax payable on dividends derived from accumulated profits.

- If not fully offset, it may be credited against the income tax of the fiscal year in which dividends are distributed, or against income tax of other periods, within 3 years from when the credit became enforceable.

- If not offset, the taxpayer may request a refund of the remaining balance within 3 years from the date of payment.

2. Capitalization:

- Offset first against income tax of any fiscal year.

- If not fully offset, a refund may be requested within three years from the date of payment.

Holding companies and entities subject to a single income tax regime may request the refund from the first day of the month following the capitalization or dividend distribution, for the portion of the credit not offset, within 3 years.

The offset or refund shall be made in the same proportion as the amount distributed and/or capitalized.

d. Capitalization of Profits

For the purpose of offsetting or refunding the advance payment due to capitalization of profits, the capitalized value must be used for any of the following activities:

- Acquisition of new productive assets purchased as of August 28, 2025, such as property, plant and equipment, intangible assets, and biological assets, intended for the taxpayer’s productive or commercial process. The change of ownership of operating assets or those located abroad shall not be considered.

- Acquisition of new inventories as of August 28, 2025, such as raw materials, supplies, intermediate goods, and finished goods forming part of the business operating cycle.

- A net increase in employment of at least 5% compared to the fiscal year preceding the investment year. The net employment growth will be calculated as:

Net employment growth = (total jobs – previous jobs) / previous jobs

e. Non-Deductible Expense

Taxpayers that neither distribute nor capitalize their accumulated profits within the two fiscal years following the year in which the advance payment was made shall not be entitled to offset or request a refund. Consequently, the paid amount will become a non-deductible expense in the fiscal year when that term expires.

- Special Regime for the Advance Payment on Undistributed Profits for Fiscal Year 2025

f. Calculation Formula

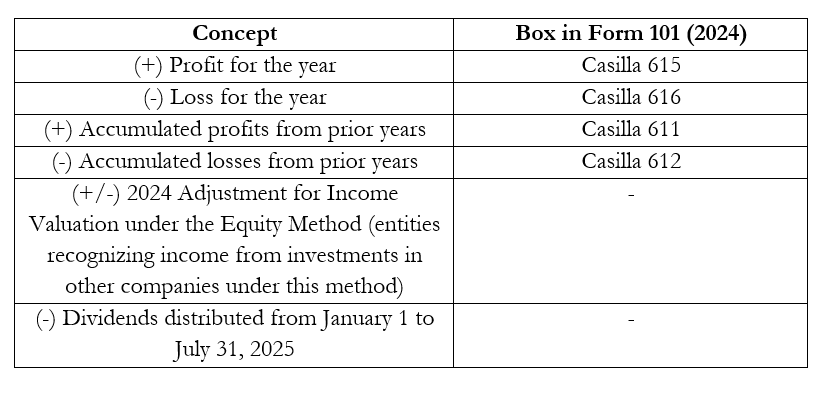

To calculate the taxable base for fiscal year 2025, taxpayers will use the information included in the 2024 income tax return filed by July 31, 2025, disregarding any amended returns filed after that date:

g. Payment Methods and Dates

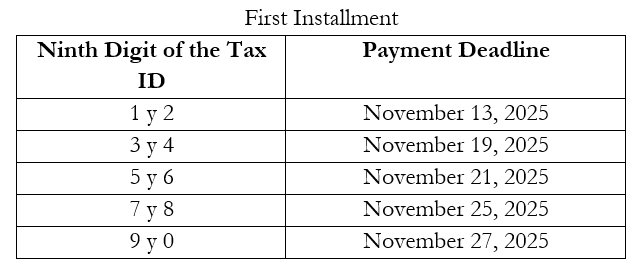

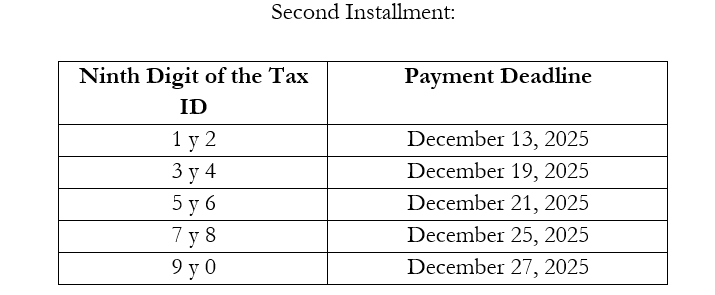

Only for the 2025 fiscal year, taxpayers must file and pay the obligation in two equal, interest-free installments during November and December, according to the following schedule:

First Installment:

Second Installment:

Holding companies are not subject to this payment for fiscal year 2025.

h. Offset and/or Refund for Dividend Distribution or Capitalization

For the purposes of offset or refund for fiscal years 2025 and 2026 related to profit capitalization, the acquisition of new productive assets, property, plant and equipment, biological assets, and/or inventories made during the two fiscal years immediately preceding the publication date of the Law shall be considered, provided that they are incorporated into the productive process.

Andrea Moya, Parner at CorralRosales

amoya@corralrosales.com

+593 2 2544144