Do you want to receive our newsletters with information like the one you just read?

Click here and subscribe.

Income and VAT withholdings regime applicable to payment aggregators and online markets

Do you want to receive our newsletters with information like the one you just read?

Click here and subscribe.

The Organic Law of Communication (“LOC”) determines, in article 98, the rules of nationality for the production of advertisement to be disseminated through social communication media (“Rules of Nationality of Production”) which establish that advertisements transmitted through the social communication media:

Art. 98. – Production of National Advertising. – Advertising that is disseminated in Ecuadorian territory through the communication media must be produced in Ecuadorian territory by Ecuadorian natural persons or foreigners residing in Ecuador or produced abroad by Ecuadorian persons residing abroad or foreign legal entities whose ownership of the majority of the shares in said entity is held by Ecuadorian persons and whose payroll for its realization and production is made up of at least 80% of people of Ecuadorian nationality.

This payroll percentage will include the hiring of professional services.

The import of advertising pieces produced outside the country by foreign companies is prohibited, with the exception set forth in the first paragraph regarding foreign legal entities with a majority of the share package held by Ecuadorian persons.

For the purposes of this law, advertising production is understood to be television and film commercials, radio sports, photographs for static advertising, or any other audiovisual piece used for advertising purposes.

The advertising of international campaigns designed to promote respect and the exercise of human rights, peace, solidarity and human development is exempt from what is established in this article.

Social communication media are defined in the LOC as: “… public and private entities and community organizations, as well as the concessionaires of radio and television frequencies, who provide the public service of mass communication that utilize print media o radio services, television and audio and video subscription services, whose contents can be generated or replicated by the media through the internet.”

The Regulation for the Application of the LOC, among other aspects, regulated the application of the Rules of Nationality of Production for advertisement through alternative channels other than social communication media; and clarified on its application for each type of advertising piece in the case of advertisements aimed at promoting tourist destinations or events abroad or those in which the images of famous people or animated fictional characters that are the image of the brands are used. The derogatory provided by Executive Decree 32 has the following relevant implications in terms of advertising:

– Advertisement to be disseminated through alternative media such as (i) billboards or photographs located in public space in commercial premises; (ii) catalogs; (iii) flyers is no longer subject to the Rules of Nationality of Production.

– Importing printed advertising materials such as diaries, notebooks and catalogs is allowed.

– There is no prohibition for advertisement photography to be disseminated by social communication media to be taken by a foreign photographer – that is not an Ecuadorian resident – as long as the Rules of Nationality of Production regarding the property of the producer is complied with and the production team is at least made up of 80% Ecuadorians.

– There are no guidelines that regulate the application of Rules of Nationality of Production in the case of advertising intended to promote touristic destinations or events located outside Ecuador, the use of images of famous people or animated characters that are the international image of a brand (the derogated Regulations for the application of the LOC allowed the use of these videos/images for up to 20% of the duration of the video or the composition of the piece).

Do you want to receive our newsletters with information like the one you just read?

Click here and subscribe.

This Executive Decree establishes the standards to which the public servants of the Executive Branch to achieve a transparent and efficient public administration at the service of the citizens.

Below the main standards of the Executive Decree No. 4:

Nepotism: Relatives of the president, vice president, ministers and vice ministers of State, secretaries and undersecretaries of State, managers, and directors of public companies, up to the fourth degree of consanguinity and second degree of affinity or those with whom there is a relationship by common-law relationships, cannot be hired or appointed within the same administrative entities. The relatives of the aforementioned officials, within the stated degrees, cannot contract directly nor indirectly with public entities of the Executive Branch.

The use of public assets and resources shall be exclusively for the performance of specific duties

Conflicts of interest shall be declared, and the public servant is prevented form intervening in matters in which such conflicts exist.

Transparency, which includes:

– The promotion of good corporate practices.

– The entities that are part of the Executive Branch will promote the contracting of national and foreign companies that have adopted codes of good corporate practices, including commitments against corruption, environmental protection, promotion of human rights, labor safety and non-discrimination.

– Companies that have their corporate headquarters in countries where executives of such companies are not sanctioned for corrupt practices incurred abroad will not be contracted. It is prohibited to contract with individuals or legal entities that have outstanding assessments from the Comptroller General’s Office.

– It is prohibited to receive gifts, presents, or any other type of benefit, gift or reward, invitations, payments in restaurants, from national or foreign executives or private persons who do or intend to do business or have any other type of commercial relationship with the State.

– When a public official attends an event due to his/her functions, and the protocol so dictates he/she may give and receive gifts that its value does not exceed USD$200.

Equal opportunity and fair treatment by Executive Branch officials who will not discriminate any person based on race, ethnicity, gender, marital status, nationality, age, political affiliation, religion or sexual orientation. Public servants shall be kind, friendly and polite and shall not get involved in situations, activities or interests incompatible with their functions, refraining from any conduct that may affect their independence of judgement.

The Secretary of State for Public Administration and Cabinet will oversee supervision and compliance.

Do you want to receive our newsletters with information like the one you just read?

Click here and subscribe.

This is the first data protection law in Ecuador, which represents a radical change in the processing and security mechanisms of personal data.

The Data Protection Law has 77 articles distributed in 12 chapters. The main elements and obligations are the following:

Do you want to receive our newsletters with information like the one you just read?

Click here and subscribe.

MEDIA: LexLatin

Ecuador will publish in the coming days its first Personal Data Protection Law in the most European style after a long time working on it. Our senior associate Rafael Serrano writes about it in LexLatin.

This great advance for Ecuador, although the right was guaranteed since 2008 but without a norm that would regulate it, will allow companies to have a refined database with globally homogenized standards and, above all, to have greater protection of the personal information.

In the words of Rafael Serrano, “it is about establishing a framework of parameters to process correct information”.

All those people who store information that identifies or makes any individual identifiable, directly or indirectly, and in any type of support, will be affected by this rule.

To review whether the law is being complied with, a personal data protection authority has been created. “If the president does not veto the project, this authority, the Superintendency, will be independent and with overseeing power in both the private and the public sectors,” adds Serrano.

In addition, this law has established parameters for international communications and transfers with personal data. It has also stablished rights so that consultation, digital education, and girls, boys and adolescents would not be the subject of a decision based solely or partially on automated valuations.

Serrano points out, “one of the most discussed issues was whether or not there was a need to create a record of the databases in the possession of those responsible. This does not mean that this information is delivered to the Superintendency to create a large database, but rather that what is delivered responds to statistical purposes: for example, what data is being processed and how many databases are there”.

The law establishes that the consent for a person to be registered in a database will only be valid when it is manifested freely, specifically, informed and unequivocally.

As Serrano explains, the information required by companies is “the purpose of the data treatment, the legal basis, the types of treatment that exist, the time of their conservation, the existence of a database , the purposes, a contact person in charge, the transfers that are intended to be made and the existence of automated evaluations and decisions, among others”.

“Those responsible for the processing of personal data are obliged to sign confidentiality contracts and proper handling of personal data with the person in charge and the staff in charge of the processing of such personal data or whoever has knowledge of the personal data, in addition to using technologies to mitigate and evaluate the performance or the violations that their protection mechanisms may have ”, concludes Serrano.

MEDIA: AIPPI

Pharmaceutical patent licenses are generally granted by means of agreements freely executed between the patent holder and the person authorized to exploit the invention. However, this is not always the case, since in some exceptional cases, they are granted by order of the authority under the conditions set forth in the Law. Our partner, María Cecilia Romoleroux, and our professional technician, Gabriel Kuri, write about this for AIPPI Ecuador.

The Commission of the Andean Community of Nations -CAN- provides for the granting of compulsory licenses for reasons of public interest, emergency or national security, if there are practices that affect free competition, and when requested by the holder of a patent, provided that it necessarily requires the use of another patent. This requires the prior notice to the licensee, whenever possible, and a specification of the period for which it is granted, the object of the license, the amount, and the conditions of the financial consideration.

In 2009, the Ecuadorian Government declared access to medicines used in the treatment of certain diseases that affect the population and that are a priority for public health, as a matter of public interest. As a consequence, it declared the possibility of granting compulsory licenses. “In addition, it declared that, in principle, all medicines and agrochemicals would be subject to compulsory licensing as there are basic concepts that prevail over commercial interests,” add our experts.

For this reason, while recognizing the right of each country to order compulsory licenses for patent-based medicines under the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), Ecuador declared access to medicines used in the treatment of priority diseases to be in the public interest.

Last March 2021, the Andean Court of Justice issued a preliminary ruling (interpretación prejudicial) stating that ” among the situations in which the competent national offices have the power to grant compulsory licenses, are those related to reasons of public interest, emergency, or national security “, they add. Therefore, the granting of a compulsory license does not affect the right of the patent holder to continue exploiting the patent.

Our experts, based on their experience, state that “the granting of a compulsory license requires that the competent authority of the Member Country evidences, explains and adequately and sufficiently substantiates the reasons of public interest, emergency or national security, as well as the need to adopt such measure, which must meet three reasonableness requirements”. “It must also substantiate the reasons that justify that, under these circumstances, it is essential to grant a compulsory license.”

“The preliminary ruling clearly establishes that it is not enough to simply state one or more conditions included in Article 65 of Decision 486, but that these must be explained, detailed and even individualized for each case,” they conclude.

1. Haiti

2. Republic of the Congo

3. Mali

4. Ivory Coast

5. Myanmar

Nationals of these countries that carry diplomatic, official or special passports, subject to reciprocal visa exemptions under multilateral and bilateral agreements signed by the Republic of Ecuador, are exempted from this provision.

The above mentioned are added to the nationals of the following countries who also require a visa to enter Ecuador:

Afghanistan, Angola, Bangladesh, Cameroon, North Korea, Cuba, Egypt, Eritrea, Ethiopia, Filipinas, Gambia, Ghana, Guinea, India, Irak, Irán, Kenia, Libya, Nepal, Nigeria, Pakistan, Democratic Republic of Congo, Senegal, Syria, Sri Lanka, Somalia, Venezuela, Vietnam and Yemen.y.

Do you want to receive our newsletters with information like the one you just read?

Click here and subscribe.

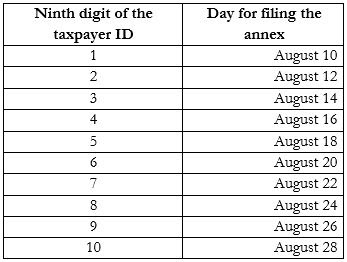

When the filing date is a national or local holiday, the annex may be filed on the following business day, unless it falls on the following month, in which case this rule will not apply, and the annex must be filed in the previous business day.

Do you want to receive our newsletters with information like the one you just read?

Click here and subscribe.

CorralRosales will participate in the next seminar organized by the Inter-American Association of Intellectual Property (ASIPI), titled “Beyond a year of change“, which will take place from May 23 to 25, 2021.

The most important Intellectual Property association in Latin America is organizing this event, which will be held online through an innovative platform, in which all members will be able to participate free of charge.

The academic program will address current topics, as well as networking activities, which will involve a high level of participation.

CorralRosales Will participate as a golden sponsor, register and don´t miss it! You can do so by clicking here.

MEDIA: World Trademark Review

Our associate Andrea Miño, specialist in Intellectual Property, has published a new article in World Trademark Review on the contradictory criteria for the examination of trademarks in similar cases in the Andean Community.

In the words of our expert, “It’s the principles of primacy and direct effect on the obligation of member states to optimize the specialized legal system to ensure strict and uniform compliance with Andean community regulations. At the same time, the principle of autonomy empowers the competent offices to issue resolutions without affecting the decisions adopted by other member countries or their own; however, the decisions must be issued in strict adherence to what is established in the regulations and jurisprudence that governs the trademark area at the community level”.

Taking this context into account, the decisions issued by the IP offices of Ecuador, Colombia and Peru should be analyzed, since the criteria given are contradictory for the registrability of the same trademark intended to cover identical products.

Our associate also states in this publication that “In the case of Ecuador, Resolution No. 0004531, the National Industrial Property Directorate of the National Intellectual Rights Service (SENADI), determined that the same trademark, which protected class 5 products, did not meet the requirements for registration, since it was included in one of the grounds for refusal of registration provided for in the Andean Community regulations; that is, the trademark made direct reference to the products it intended to identify”.

SENADI, however, ignored the mixed nature of the trademark and only established that the trademark applied for “was not distinctive because it was a generic and descriptive term, and commonly used.”

If you want to see the article (under registration), click here